Friday, December 31, 2010

PEMBERITAHUAN: Personal Coaching Akan Dianjurkan Bermula February/March 2011

Ucapan ribuan terima kasih saya ucapkan kepada para pembeli ebook RJFCPO. Selepas saya menghantar email tentang cara-cara bayaran, didapati ramai yang membuat bayaran segera.SEKALI LAGI JUTAAN TERIMA KASIH...

Ramai juga yang bertanyakan tentang program "PERSONAL COACHING"....Insyaallah bulan Feb/March saya akan anjurkan. TETAPI fahamkan dulu teknik SNIPER SAWIT yang saya dedahkan. Ya saya beri masa 1 bulan untuk anda praktikkan dan fahamkan teknik ini. Dari situ banyak yang akan anda pelajari... Apabila anda menghadiri "PERSONAL COACHING" maka mudahlah anda untuk memahami dengan lebih lanjut....

Saya doakan semoga para pembeli ebook RJFCPO membuat keuntungan yang konsisten bagi tahun 2011. Insyaallah..

-SELAMAT MAJU JAYA-

PENGUMUMAN: Cara-cara Pembayaran Ebook RJFCPO Telah Diemail

Untuk makluman anda semua, saya telah menghantar email cara-cara bayaran untuk membeli ebook RJFCPO. Sila semak email anda.

Bagi sesiapa yang masih belum menerima email daripada saya, anda boleh hubungi saya melalui email dan saya akan menghantar email cara-cara bayaran secepat mungkin.

Dikesempatan ini juga saya ingin mengucapakan "SELAMAT TAHUN BARU 2011". Semoga dengan kedatangan tahun 2011 kita akan mendapat limpahan rezeki dari ALLAH s.w.t.

-SELAMAT MAJU JAYA-

Ikhlas

-jutawansawit-

Thursday, December 30, 2010

Thursday Trading Tip: Bearish Trend Expected

Hi traders,

CPO ended lower on Wednesday at 3733lvl with low volume traded. CPO seems to test 3700-3750 level. CPO may upside bias if open > 3750-3760 and close > 3760. If open below <3720 the bearish tone may take place. Major trend is upside bias with pullback corrections. If CPO breakout 3700lvl, the trend may continue for strong bearish tone towards 3650. I'm expecting CPO may play 3690-3750 today. Pls take your position nicely...

Happy trading & Wassalam...

Just my 2cents

Wednesday, December 29, 2010

Wednesday Trading Tips: CPO Tired

Hi traders,

CPO ended higher on Tuesday at 3778lvl with low volume traded. Nothing much improvement during AM & PM session thus cautious of reversal may developed. Formations of evening star...... Confirmation by today....CPO tired already. CPO seems to test back 3750-3800 level if open above 3770, but be careful on pullback correction. CPO may upside bias if open > 3755-3790 and close > 3780. If open below <3750 the bearish tone may take place. Major trend is upside bias with pullback corrections, maybe last wave..... If CPO breakout 3800lvl, the trend may continue for strong bullish tone towards 4000. I'm expecting CPO may play 3760-3810 today. Pls take your position nicely...

Happy trading & Wassalam...

Just my 2cents

Tuesday, December 28, 2010

Tuesday Trading Tip: Bullish Trend Continue

Hi traders,

CPO ended higher on Monday at 3756lvl with high volume traded. PM session rallied after 3700 breakout. CPO seems to test 3750-3800 level if open above 3750, but be careful on pullback correction. CPO may upside bias if open > 3735-3755 and close > 3760. If open below <3720 the bearish tone may take place. Major trend is upside bias with pullback corrections. If CPO breakout 3800lvl, the trend may continue for strong bullish tone. I'm expecting CPO may play 3740-3780. Pls take your position nicely...

Happy trading & Wassalam...

Just my 2cents

Sunday, December 26, 2010

Monday Trading Tip: Continue Bullish EXPECTED

Hi traders,

CPO ended higher on Friday at 3665lvl with moderate volume traded. CPO seems to test back 3650-3700 level if open above 3660. CPO may upside bias if open > 3660-3675 and close > 3670. If open below <3640 the bearish tone may take place. Major trend is upside bias with pullback corrections. If CPO breakout 3700lvl, the trend may continue for strong bullish tone. I'm expecting CPO may play 3660-3710. Pls take your position nicely...

Happy trading & Wassalam...

Just my 2cents

Friday, December 24, 2010

Friday Trading Tip: Strong Bullish

Hi traders,

CPO ended higher on Thursday at 3658lvl with moderate volume traded. CPO seems to test back 3650-3700 level if open above 3650. CPO may upside bias if open > 3650-3670 and close > 3670. If open below <3620 the bearish tone may take place. Major trend is upside bias with pullback corrections. If CPO breakout 3700lvl, the trend may continue for strong bullish tone. I'm expecting CPO may play 3650-3700 today. Pls take your position nicely...

Happy trading & Wassalam...

Just my 2cents

Thursday, December 23, 2010

Thursday Trading Tip: Welcome 3600....Bullish Trend Expected

CPO ended higher on Wednesday at 3620lvl with moderate volume traded. Last minute bullish tone was significant during PM session. CPO seems to test back 3600-3700 level if open above 3620. CPO may upside bias if open > 3610-3640 and close > 3650. If open below <3600 the bearish tone may take place. Major trend is upside bias with pullback corrections. If CPO breakout 3700lvl, the trend may continue for strong bullish tone. I'm expecting CPO may play 3650-3700 today. Pls take your position nicely...

Happy trading & Wassalam...

Just my 2cents

Tuesday, December 21, 2010

Thursday, December 16, 2010

Friday Trading Tip: The Judgement Day For Bearish

Hari ni terbentuk lagi satu doji candlestick dengan volume yang terlalu sedikit. Mungkin tanda-tanda bullish akan berakhir.... Melalui analisis saya, jika CPO ditutup bawah 3570 pada esok hari. maka berakhirlah bullish trend. Kemungkinan pada minggu hadapan bearish trend akan bermula. Bermulah satu perjalanan baru bagi seekor beruang.....

Ini hanyalah analisa saya berdasarkan daily & weekly chart........Wallahualam....

Happy trading

Wednesday, December 15, 2010

NOT AVAILABLE FROM 16.12.2010

Untuk makluman tuan/puan/saudara/i saya akan bercuti bermula pada hari esok (KHAMIS) 16.12.2010 sehingga diberitahu kelak.

SELAMAT MAJU JAYA

Terima kasih

Wednesday Trading Tips: Bearish Correction

Hi traders,

CPO ended lower on Tuesday at 3680lvl with low volume traded. Last minute bearish tone was significant during PM session. After breakout 2700lvl, selloff took place. CPO seems to test back 3600-3650 level if open below 3680. CPO may downside bias if open < 3680-3670 and close < 3650. Major trend is upside bias with pullback corrections. If CPO breakout 3450lvl, the trend may confirm for bearish tone. I'm expecting CPO may play 3650-3700 today. Pls take your position nicely...

Happy trading & Wassalam...

Just my 2cents

Tuesday, December 14, 2010

Tuesday Trading Tip: Bullish tone

Hi traders,

CPO ended higher on Monday at 3722lvl with low volume traded. Bullish tone was significant during PM session and breaks 2700lvl . CPO seems to test 3750 level towards it journey to 3800 today. CPO may further upside bias if open >3700-3730 and close > 3750. CPO may downside bias if open < 3680 and close < 3650. Major trend is upside bias with pullback towards 3800. I'm expecting CPO may play 3750-3780 today. Pls take your position nicely...

Happy trading & Wassalam...

Just my 2cents

Monday, December 13, 2010

Monday Trading Tip: Continue Bullish EXPECTED

Hi traders,

CPO ended higher on Friday at 3633lvl with low volume traded. Last minute spike changed the tone to bullish territory. CPO seems to test 3650 level towards it journey to 3700. CPO may further upside bias if open >3620-3640 and close > 3650. CPO may downside bias if open < 3600 and close < 3580. Major trend is upside bias with minor correction towards 3650-3700. I'm expecting CPO may play 3650-3680 today. Pls take your position nicely...

Happy trading & Wassalam...

Just my 2cents

Sunday, December 12, 2010

SENARAI NAMA TEMPAHAN EBOOK RJFCPO

Berikut saya senaraikan nama-nama yang telah membuat tempahan untuk ebook RJFCPO. Sila pastikan nama anda telah tersenarai. Jika masih tiada sila email kepada jutawansawit@gmail.com.

Terima kasih

(1) wan zairul, (2) Azrin, (3) walan rad, (4) salim ibrahim, (5) mohd khadafi, (6) mustafa derazak, (7) kanno ken, (8) azhar azhar, (9) Matt Azuri, (10) Muhamad Al Barrak, (11) Muhamad Rais, (12) Zarah, (13) ipan napi, (14) asimo9701, (15) sahari, (16) Shahri, (17) Mai Sura, (18) man zai, (19) Al Nazzarrudin, (20) nazrul (21) azraf, (22) Megat Haris, (23) noor salleh, (24) Mohd Hisham, (25) mona badri, (26) kazam, (27) muallim mursyid,

Friday, December 10, 2010

Friday Trading Tip: Bulls or Bears?

Assalamualaikum,

Hi traders,

CPO ended lower on Thursday at 3598lvl with low volume traded. CPO seems to test back 3600 level towards it journey to 3700. CPO may further upside bias if open >3610-3620 and close > 3620. CPO may downside bias if open < 3580 and close < 3550. Major trend is upside bias with minor correction towards 3650-3700. I'm expecting CPO may play 3600-3650 today. Pls take your position nicely...

Happy trading & Wassalam...

Just my 2cents

Thursday, December 9, 2010

AWAS: Berhati-hati dengan Doji Star

Untuk makluman, jk berlaku doji star pada hari ini, dijangka trend menaik akan berakhir tak lama lagi....

Just my 2cents...

ANNOUNCEMENT: RJFCPO EBOOK -Booking your copy now...

Thanks

Tuesday Trading Tip: Hoping of Bullish

Assalamualaikum,

Hi traders,

CPO lower higher on Wednesday at 3594lvl with higher volume traded. CPO seems to test back 3600 level towards it journey to 3700. CPO may further upside bias if open >3590-3610 and close > 3610. CPO may downside bias if open < 3580 and close < 3550. Major trend is upside bias with minor correction towards 3650-3700. I'm expecting CPO may play 3580-3650 today. Pls take your position nicely...

Happy trading & Wassalam...

Just my 2cents

Wednesday, December 8, 2010

PENGUMUMAN: eBook RJFCPO Akan Dilancarkan Pada 1.1.11

Syukur alhamdulillah, akhirnya dapat juga saya menyiapkan eBook RJFCPO walaupun terdapat kelewatan bagi melancarkannya untuk tatapan ramai. Dalam tahun 2010 ini banyak suka-duka yang saya tempuhi bagi menyiapkan eBook yang pertama saya. Tidak ketinggalan juga, dalam tahun 2010 peratus keuntungan saya telah meningkat dan amat memberangsangkan.....alhamdulillah....

Dikesempatan ini saya ingin mengumumkan bahawa eBook RJFCPO akan dilancarkan pada tarikh keramat iaitu 1.1.2011. Semoga para pembaca mendapat manfaat daripada apa yang saya sampaikan.

SINOPSIS

Ebook Rahsia Jutawan Sawit (RJFCPO) mengandungi perkara asas dan konsep urusniaga CPO bagi memantapkan pemahaman para pembaca. Ia juga mendedahkan apakah bentuk-bentuk candlestick dan carta penting dalam urusniaga waulaupun terdapat pelbagai corak candlestick/carta dalam dunia seorang traders. Pendedahan ini dikhususkan hanya untuk urusniaga CPO sahaja. Dalam pada itu RJFCPO juga mendedahkan indikator-indikator penting untuk urusniaga. Bukan semua indikator yang ada boleh digunakan untuk urusniaga ini.

Topik terakhir yang pasti menjadi penantian ramai ialah pendedahan teknik SNIPER SAWIT V01 yang saya gunakan bagi menjana keuntungan.Pengenalan kepada teknik asas SNIPER SAWIT dan cara menggunakannya akan diterangkan dengan panjang lebar. Bagi memantapkan pemahaman pembaca, penulis menyertakan sekali dengan video CARA-CARA SETUP SISTEM SNIPER SAWIT & CARA MENGGUNAKANNYA.

Ebook RJFCPO disyorkan untuk traders "beginner" dan "intermediate" yang telah membuat urusniaga CPO serta bagi mereka yang masih membuat "paper trade". Ia dijual pada harga berpatutan iaitu RM 125 termasuk "video support" + ebook "A Complete Guide to Technical Trading Tactics oleh John L. Person" yang bernilai USD 150.

CARA-CARA TEMPAHAN

Bagi sesiapa yang berminat untuk memiliki eBook RJFCPO anda boleh menghubungi saya di jutawansawit@gmail.com kerana saya hanya menjual kepada 100 orang yang terawal sahaja yang mana ia adalah "LIMITED EDITION". Setiap pembeli akan diberikan no code yang berlainan yang terdapat pada ebook untuk rujukan pada masa hadapan.

- DAPATKAN NASKAH ANDA SEKARANG"

Tuesday, December 7, 2010

Wednesday Trading Tips: Bullish Tone

Assalamualaikum,

Hi traders,

CPO ended higher on Monday at 3610lvl with higher volume traded. CPO may further upside bias if open >3590-3610 and close > 3610. CPO may downside bias if open < 3580 and close < 3570. Major trend is upside bias with minor correction towards 3650-3700. I'm expecting CPO may play 3620-3650 tomorrow. Pls take your position nicely...

Happy trading & Wassalam...

Just my 2cents

Sunday, December 5, 2010

Monday Trading Tip: Continue Bullish EXPECTED

Assalamualaikum,

Hi traders,

CPO ended lower on Friday at 3516lvl with low volume traded. CPO may further upside bias if open >3530-3550 and close > 3550. CPO may downside bias if open < 3490 and close < 3470. Major trend is upside bias with minor correction towards 3600. I'm expecting CPO may play 3540-3600 tomorrow. Pls take your position nicely...

Happy trading & Wassalam...

Just my 2cents

Saturday, December 4, 2010

Palm Oils & Soy Oil News Update

NUSA DUA, Indonesia Dec 3 (Reuters) - Growth in China's palm oil demand could slow 1.7 percent to 5.9 million tonnes in the marketing year that began in Oct 2010 as the country was on a soybean buying spree and the domestic crop improves, a researcher with COFCO said.

But any damage to crops, especially in South America, where drier weather induced by La Nina has slowed soy plantings and could affect yields, may boost palm oil imports, said Jennifer Yuan, a researcher with China's state-owned trading house.

Indonesian palm tax at comfortable levels-SMART

NUSA DUA, Indonesia Dec 3 (Reuters) - Indonesia's export tax on palm oil products are at comfortable levels but any steps by the government to change the structure needs to equally benefit planters and refiners, a top plantation firm said late on Thursday.

Palm oil giant SMART TBK said the government's plan to review the export taxes, currently at their highest this year at 15 percent in December, needs to consider small farmers who do not have similar economies of scale as big planters.

Palm oil may gain more users from EU biofuel rules-Neste Oil

NUSA DUA, Indonesia Dec 2 (Reuters) - European Union rules requiring vegetable-oil based biofuels to come from eco-friendly sources may boost palm oil use in the sector as green supplies of the tropical oil grow, a key Finnish oil refiner said on Thursday.

A Neste Oil official said green groups scrutiny of the Asian palm oil sector has spurred efforts to clean up estates and supply chains, placing it in a better position than other competing oils to meet EU sustainability criteria.

U.S. soy product futures close mixed, as soymeal weakened with soybeans in setback from strong gains. Market participants took profits on previous positions in soybeans and soymeal after broad commodity rally Wednesday, analysts say. Weaker-than-expected soymeal demand added pressure, as weekly U.S. sales of 133,800 tons were below trade estimates, they say. Weekly U.S. soyoil sales of 32,100 tons beat trade estimates. CBOT January soymeal dropped $2.80 to $345.70 per short ton, and CBOT January soyoil rose 0.23 cent to 52.84 cents per pound.(Source: CME)

China Takes Action To Cap Cooking Oil Prices –Source (Source: CME)

China has put policies into place to restrain food producers from raising cooking oil prices as part of efforts to address sharply higher prices and ensure supply to the public, an industry official familiar with the situation said. The move represents the reintroduction of price caps on basic necessities, albeit applied in a single commodity market--a far narrower version of a controversial yearlong policy that went into effect in January 2008. The policy action hasn't so far placed producers at a price disadvantage, and the measures may not last beyond the Lunar New Year in early February, the person, who is linked to a major global agribusiness. "There is still a margin to be made," he said, adding that margins for producers are generally between $20 and $50 a metric ton. "The aim is not to disadvantage suppliers."

Officials from the National Development and Reform Commission, China's top economic planning agency, met executives from major food producers Cofco Ltd., Jiusan Grain and Oil Group, the Yihai Kerry Group--owned by Singapore-based Wilmar International Ltd. --and Chinatex Corp. last week to ask the companies not to raise prices for cooking oil in small-package form, the 21st Century Business Herald reported Thursday. The companies would have to apply to the commission if they wanted to raise prices during this period, it said. "There are a couple of things in play. Obviously, there is policy action to control prices and use moral suasion, and the government is also holding auctions to address supply," the person said. According to some reports, the measures could last four months, but the person said they could be briefer.

"Beyond Chinese New Year, why would you want to control prices?" he said. The price cap on cooking oil extends a government policy adopted last month to increase government control of the market. The central government at the time appointed Cofco, Yihai Kerry and Chinatex as pre-approved bidders at state edible oil auctions, and said provincial grain authorities could recommend two to five more bidders of their choice. The move, aimed at neutralizing speculators, gave a competitive advantage to the larger players. Purchases at such auctions wouldn't be permitted to be resold, the State Administration of Grain said at the time.

India 2010-11 Edible Oil Imports Likely Flat At 8.8 Mln Tons (Source: CME)

India's edible oil imports this marketing year are likely to remain unchanged from last year as domestic output will rise enough to meet higher consumption, a senior industry executive said. India imported 8.8 million tons of edible oil in the year ended Oct. 31. The country is the world's largest edible oil importer and meets more than half of its requirements through imports. "The summer-sown oilseeds crop projection is higher. So the 3%-4% increase in [edible oil] demand could be made up by higher domestic oilseeds production," Sushil Goenka, president of the Solvent Extractors' Association of India, said. According to the Central Organization of Oil Industry and Trade, India's summer-sown oilseeds output in the marketing year that started Oct. 1 is likely to jump 12.4% to 15.4 million tons from 13.7 million tons last year. In 2009-10, the country's imports climbed to a record as international prices were low and the local crop shrank after the worst drought in nearly four decades.

India imports palm oil mainly from Indonesia and Malaysia, and soyoil mostly from Brazil and Argentina. "Sunflower oil imports may be lower [in 2010-11] due to higher prices and increasing price difference between soyoil and sunflower oil," Goenka said. Sunflower usually commands a premium over soyoil, but now the difference has widened to $250-$300 a ton from about $50-$100/ton a year earlier. India imported 630,005 tons of sunflower in 2009-10, while soyoil imports stood at 1.7 million tons. Goenka added that soyoil imports this marketing year will depend on the price difference with palm oil. The premium of soyoil over palm oil is currently $60-$80/ton. The Solvent Extractors' Association of India is also seeking the imposition of a 10% import tax on crude edible oil to protect local farmers, Goenka said. India doesn't impose any import tax on crude edible oils, but levies a 7.5% tax on refined edible oils.

Wheat dips from 3-wk top; corn, soy ease on profit-taking

SINGAPORE, Dec 2 (Reuters) - U.S. wheat fell around half a percent on Thursday as the market took a breather after climbing more than 7 percent in the previous session, the biggest rise in around 2 months, amid crop concerns and a broad based commodities rally.

"The slight weakness in Chicago market is perhaps just a pause after the steep rise that we saw yesterday," said Luke Mathews, a commodity strategist at Commonwealth Bank of Australia.

Palm at new 28-mth highs on global commods, weather

KUALA LUMPUR, Dec 2 (Reuters) - Malaysian palm oil futures hit a fresh 28-month high on Thursday, tracking firmer global commodity markets and concerns over low production during the monsoon season.

"Palm oil is up mainly on overseas factors, especially the stronger grain and soy complex," said a trader

Heavy rain headed for Brazil's No. 2 soy state

SAO PAULO, Dec 1 (Reuters) - Most of Brazil's southern soybean states will get heavy rainfall over the weekend, which will favor development of the newly planted crops there, Somar forecast Wednesday.

No. 2 soy producing state Parana is expected to get 89 millimeters (3.5 inches) over the next five days. It has seen the best rainfall of the major soybean states since planting started in mid-September.

Palm oil may gain more users from EU biofuel rules-Neste Oil

NUSA DUA, Indonesia Dec 2 (Reuters) - European Union rules requiring vegetable-oil based biofuels to come from eco-friendly sources may boost palm oil use in the sector as green supplies of the tropical oil grow, a key Finnish oil refiner said on Thursday.

A Neste Oil official said green groups scrutiny of the Asian palm oil sector has spurred efforts to clean up estates and supply chains, placing it in a better position than other competing oils to meet EU sustainability criteria.

Argentine law reform could double soy seed sales

CHACABUCO, Argentina, Dec 1 (Reuters) - A new law being studied by Argentina's government could double sales of soy seeds, guaranteeing companies royalty payments and encouraging them to introduce new varieties, a leading supplier said on Wednesday.

The introduction of genetically modified (GMO) soy has helped Argentine farmers boost output dramatically over the last 14 years, but current regulations have deterred seed companies from marketing strains using the latest technology.

BREAKING NEWS

Thomas Mielke :Malaysia Palm Oil Futures Price will fall in second half of 2011 on strong production and the incoming U.S soy crop. Palm Oil price will rise strongly in Jan ~ Apr 2010 by RM470 of current RM3525 level due to tight supply and high demand.

James Fry :Palm Oil prices to fall to RM2,600 by Jun 2011

Dorab Mistry :

Malaysia Palm Oil Futures to Hit RM3,600 in Dec 2010 ~ Jan 2011.Asian Crude Palm Oil Output to continue to underperform. Greatest period of tightness seen in Q1 2011.Asian Palm Oil output to recover from Apr 2011 onwards but "Will not be strong or impressive".

BREAKING NEWS

Thomas Mielke :Malaysia Palm Oil Futures Price will fall in second half of 2011 on strong production and the incoming U.S soy crop. Palm Oil price will rise strongly in Jan ~ Apr 2010 by RM470 of current RM3525 level due to tight supply and high demand.

James Fry :Palm Oil prices to fall to RM2,600 by Jun 2011

Dorab Mistry :

Malaysia Palm Oil Futures to Hit RM3,600 in Dec 2010 ~ Jan 2011.Asian Crude Palm Oil Output to continue to underperform. Greatest period of tightness seen in Q1 2011.Asian Palm Oil output to recover from Apr 2011 onwards but "Will not be strong or impressive".

BREAKING NEWS

Thomas Mielke :Malaysia Palm Oil Futures Price will fall in second half of 2011 on strong production and the incoming U.S soy crop. Palm Oil price will rise strongly in Jan ~ Apr 2010 by RM470 of current RM3525 level due to tight supply and high demand.

James Fry :Palm Oil prices to fall to RM2,600 by Jun 2011

Dorab Mistry :

Malaysia Palm Oil Futures to Hit RM3,600 in Dec 2010 ~ Jan 2011.Asian Crude Palm Oil Output to continue to underperform. Greatest period of tightness seen in Q1 2011.Asian Palm Oil output to recover from Apr 2011 onwards but "Will not be strong or impressive".

Wednesday, December 1, 2010

My Long Setup: Just to Share

Thursday, November 18, 2010

Thursday Trading Tip: Bye...bye 3300

Hi traders,

CPO ended lower on Tuesday at 3265lvl with high volume traded. CPO may further downside bias for correction if open < 3260-3288 and close < 3260. Major trend is upside bias with bearish correction. Pls take your position nicely...

Happy trading & wassalam...

Just my 2cents....

Tuesday, November 16, 2010

Tuesday Trading Tip: Hoping of Bullish

Assalamualaikum,

Hi traders,

CPO ended high on Monday at 3375lvl with low volume. Very volatile trading hour finally pushed the CPO into positive territory and bullish tone developed after breaks above 3350lvl. I'm expecting CPO may bullish again if open > 3365-3380 and close 3390. Otherwise it may back to bearish tone for correction. Overall trend still in upside bias towards 3400lvl. Take your position nicely....

Happy trading & wassalam...

Just my 2cents..

Friday, November 12, 2010

Friday Trading Tip: Bullish Still There

Hi traders,

CPO ended lower Thursday at 3396lvl with high volume after profit taking activity by traders on PM session. It is expected CPO may continue bullish if open > 3406 and close >3410. Otherwise it will downside correction prior to make a new high. Major trend is still upside bias towards 3450lvl. Take your position nicely....

Happy trading and wassalam...

Just my 2cents

Thursday, November 11, 2010

Thursday Trading Tip: Bullish Trend Expected

Hi traders,

CPO ended higher Wednesday at 3393lvl with high volume. It is expected CPO may continue bullish if open > 3393 and close >3400. Otherwise it will downside correction. Major trend is still upside bias towards 3450lvl. Take your position nicely....

Happy trading and wassalam...

Just my 2cents....

Wednesday, November 10, 2010

Wednesday Trading Tips: Bull or Bear

Hi traders,

CPO super bullish yesterday ended at 3363lvl, totally diminished the bearish correction tone. CPO may continue it bullish tone if open > 3363 and close > 3370. Otherwise it may downside bias for correction. Overall trend is still upside bias towards 3400lvl. Take your position nicely.....

Happy Trading & wassalam..

Just my 2cents...

Tuesday, November 9, 2010

Tuesday Trading Tip: Downside Correction

Hi traders,

CPO ended higher on Monday at 3273lvl with open gap. It is likely to downside correction after open gap almost 100pt. I'm expecting CPO may further downside for correction if open < 3280-3270 and close < 3265. Otherwise it may bullish tone if open > 3296 and close >3300. The major trend still upside bias towards 3400lvl with correction. Please take your position nicely.....

Happy trading....

Just my 2cents....

Wassalam....

Monday, November 8, 2010

Monday Trading Tip: Continue Bullish

Hi traders,

CPO ended higher on Thursday at 3191lvl with high volume. It is confirmed CPO had making a new higher and expected bullish tone will continue towards 3200-3400lvl. Please be careful on downside correction if CPO open < 3150lvl and close < 3120. I'm expecting CPO may upside bias if open > 3150-3210 and close >3200. Take your position nicely....

Happy trading

Just my 2cents...

Wassalam...

Thursday, November 4, 2010

Thursday Trading Tip: Correction

Hi traders,

CPO ended slightly lower Wednesday with low volume at 3087lvl. Again it try to breaks 3106, but very shy to go further. I'm expecting CPO may enter into correction phase after a few doji star formed in daily chart prior to making new uptrend. CPO still in upside bias range bound if open > 3090 and close > 3090. Otherwise it may go to temporary downside bias range bound. Take your position nicely......

Thanks....

Wassalam...

Wednesday, November 3, 2010

Wednesday Trading Tips

Hi traders,

CPO ended higher yesterday at 3090lvl with highest lvl at 3106. CPO expected to bearish tone if open < 3080-3085 and close <3080 today. But may bullish tone if open > 3090-3000 and close > 3000. Major trend is still upside bias towards 3100-3200vl. However based on my analysis CPO may exhausted in short term prior making new uptrend. Take your position nicely.

Just my 2cents....

Happy Trading

Wassalam.....

Tuesday, November 2, 2010

SAYA TELAH KEMBALI......

Terlebih dahulu saya memohon maaf kepada semua traders kerana telah lama tidak mengemaskini blog jutawansawit. Untuk makluman saya telah mengalami demam denggi yang teruk dan ditahan di hospital untuk sekian lama. Walaupun telah pulih dan kembali daripada hospital, kesihatan saya masih tidak mengizinkan untuk online....

Alhamdulillah kini saya telah semakin sihat dan insyaallah akan aktif seperti biasa. Doakan semoga kesihatan saya semakin pulih......

Berkat dari pengalaman ini saya terfikir sejenak bahawa benarlah pepatah mengatakan......INGATLAH & HARGAILAH & BERSYUKURLAH & MANFAATKANLAH KE JALAN ALLAH......

1. Sihat sebelum sakit

2. Kaya sebelum miskin

3. Lapang sebelum sempit

4. Hidup sebelum mati

5. Muda sebelum tua

Sekian....

Wassalam....

Thursday, September 23, 2010

Friday Trading Tip: Sideway

Hi traders,

CPO ended lower today at 2671lvl with higher at 2699lvl seems like very shy to test 2700lvl. After making 3rd consecutive day with red candles, CPO expected to sideway range bound tomorrow. The bearish tone may develops tomorrow if open < 2677-2665 and close < 2665. However CPO may bullish tone if open > 2690-2695 and close > 2695. Overall trend is still upside bias towards 2700lvl. Please pay extra careful if CPO touch down 2650lvl tomorrow the short term bearish trend may develop. Take your position nicely....

Just my 2cents...

Happy trading

Wassalam...

Tuesday, September 21, 2010

Wednesday Trading Tips: Bearish Correction

Hi traders,

CPO ended lower at 2674lvl for correction after making huge open gap on Monday. CPO expected to bearish tone if open < 2680-2670 and close <2670 tomorrow. But may bullish tone if open > 2690-2700 and close > 2700. Major trend is still upside bias towards 2800lvl. Take your position nicely.

Just my 2cents....

Happy Trading

Wassalam.....

Monday, September 20, 2010

Thursday Trading Tip: Bullish Trend Confirmed

Hi Traders,

CPO open gap and ended higher at 2708lvl making upside bias confirmed. CPO may continue bullish if open > 2707-2720 and close > 2715. But may downside bias for correction if open <2690 and close <2680. I'm expecting CPO may upside bias with possible of pullback correction. Please careful.....Take your position nicely....

Just my 2cents....

Happy Trading...

Wassalam....

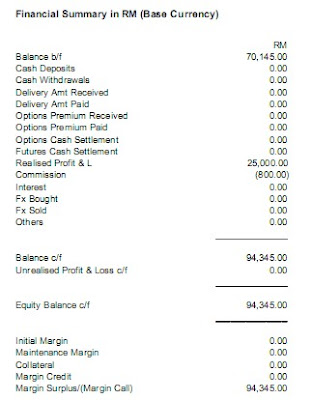

Today is Another Wonderful Day

Today i have collected 980 points after making LONG position since Friday last week. If i'm not mistaken one of my follower has been noticed to take LONG position together with me during chatting session. Hope he/she also got the profit......

The Power of "SNIPER SAWIT"

Wassalam......

Sunday, September 19, 2010

Monday Trading Tip: Chances of Bullish

Hi Traders,

CPO ended higher Friday at 2627lvl. It is expected CPO may bullish on Monday if open > 2615-2630 and close > 2630. But it may downside tone if < 2612-2600 and close < 2695. I'm expecting CPO to test 2615-2650 on Monday. Overall trend is still upside bias with correction. Take your position nicely.

Just my 2cents

Happy Trading

Wassalam...

Wednesday, September 15, 2010

Friday Trading Tip: Bearish Correction

Hi traders,

CPO ended lower today at 2615lvl. Bearish tone was developed today confirming yesterday bearish engulfing pattern. CPO may further downside bias on Friday if open < 2620 and close < 2600. But it may upside bias if open > 2640 and close > 2650. Take your position nicely...

Just my 2 cents

Happy Trading...

Wassalam....

Tuesday, September 14, 2010

Wednesday Trading Tips: Extra careful on Bearish Tone

Hi traders,

I just came back from Hari Raya holiday and don't have any position since Thursday last week. Today CPO ended lower at 2643lvl, making significant bearish tone developed. Expected CPO may downside bias if open < 2650 and close < 2620. It is supported by bearish engulfing candle on daily chart. However it may upside bias if open > 2660 and close > 2665. Overall trend is still in bullish tone with correction. But please be careful on continue bearish tone that might change the trend in short term trading. Take your position nicely.....

Just my 2cents

Happy trading

Wassalam....

Wednesday, September 8, 2010

Thursday Trading Tip: Bullish Trend on-track

Hi traders,

CPO ended higher at 2674lvl today. CPO may rally if breaks 2680lvl tomorrow and continue the upside bias towards 2700lvl. Overall trend in bullish tone. Take your position nicely....

Just my 2cents

Happy trading

Wassalam...

Wednesday Trading Tips: Bullish Tone

Hi traders,

CPO ended slightly higher yesterday at 2628. Bullish tone may continue if open > 2624-2640 and close >2620. But it may downside bias correction if open < 2620-2610 and close < 2610. CPO still in upside bias towards 2650. Take your position nicely....

Just my 2cents...

Happy Trading...

Wassalam....

Monday, September 6, 2010

Tuesday Trading Tip: Significant Bullish

Hi traders,

CPO ended higher today at 2620lvl. Confirmed bullish trend had developed after moving up and down for a few days looking for firm direction. CPO may upside bias tomorrow if open > 2600-2630 and close > 2610. Otherwise CPO may downside bias if open < 2600-2590 and close < 2590. Pullback correction may exist tomorrow after CPO moving higher at 2630 today. Overall trend now was upside bias towards 2650lvl Please take your position nicely....

Just my 2cents...

Happy trading...

Wassalam...

Friday, August 27, 2010

Friday Trading Tip: Bullish Still There

Hi traders,

CPO ended higher at 2530 yesterday. CPO may continue its upside bias if open > 2520-2530 and close > 2550. However if CPO can breaks 2560, the bullish trend may back on-track. Otherwise CPO may downside bias if open < 2500-2510 and close < 2500. Take your position nicely...

Just my 2 cents....

Happy trading....

Wassalam....

Thursday, August 26, 2010

PENGUMUMAN: KELEWATAN PELANCARAN EBOOK RAHSIA JUTAWAN FCPO

Assalamualaikum...

Assalamualaikum...Kepada pembaca,

Di atas sebab-sebab yang tidak dapat dielakkan, pelancaran ebook RJFCPO tidak dapat dibuat pada 31.8.2010 seperti yang dijanjikan sebelum ini. Saya akan mengumumkan pada satu tarikh yang sesuai untuk pelancaran dalam blog ini nanti.

Segala kesulitan amat dikesali....

Happy Trading & Wassalam....

Thursday Trading Tip: New Bearish Trend May Develop

Hi traders,

CPO ended lower at 2486 with higher volume traded. Bearish tone may continue if open < 2500-2490 and close < 2485. CPO may range bound if open > 2510-2524 and close > 2530. I'm expecting CPO may downside bias towards 2460 today. If CPO breaks 2450 today the new downside trend may develop. Take your position nicely....

Just my 2 cents....

Happy trading....

Wassalam....

Wednesday, August 25, 2010

Wednesday Trading Tips: Bear or Bull

Hi traders,

CPO ended lower at 2510 with high volume yesterday. Diminish Doji sign of Bull. But if CPO open > 2530 and close above it, the chances for bull still there. However it may bearish tone if open < 2510 and the bearish trend may continue. Take your position nicely....

Happy trading.....

Wassalam...

Monday, August 23, 2010

Tuesday Trading Tip: Doji-Sign of Bullish

Hi traders,

CPO ended higher today at 2560 lvl. Standby long position if CPO breaks 2572lvl tomorrow since Doji Star formed in daily chart. Bullish tone may develop back....Otherwise stay away from market until strong trending develop for bearish tone.Take your position nicely.....

Happy Trading

Wassalam

Thursday, August 19, 2010

Friday Trading Tip: New Bearish Trend May Develop

Hi traders,

CPO ended slightly higher at 2595lvl. Sharp decline of CPO within this week may continue if CPO open < 2580-2570 and close < 2570. But CPO may maintaining his bullish tone if open > 2590-2600 and close > 2600. I'm expecting CPO to range bounce tomorrow towards 2600lvl. However if CPO breaks 2560lvl tomorrow the bearish trend may continue. Take position nicely....

Just my 2cents...

Happy Trading...

Wassalam

Wednesday, August 18, 2010

Thursday Trading Tip: Downside Correction

Hi traders,

CPO ended lower today at 2610 lvl with high volume traded. Strong bearish tone took place the whole day making the CPO to test 2590lvl. CPO may downside correction tomorrow if open < 2620-2590 and close < 2600. But it may upside if open > 2650-2660 and close > 2660. If CPO breaks 2595lvl, the downside biased may significant towards 2560lvl. However major trend is still upside biased with temporary correction. Please be careful with your position...

Just my 2cents

Happy trading

Wassalam...

Tuesday, August 17, 2010

Tuesday Trading Tip: Bearish Engulfing Sign

Hi traders,

CPO ended lower on Monday at 2678 despite open higher at 2728. The bullish momentum exhausted when export data Aug 1-15 from SGS & ITS were fell 16% and 7.4% respectively. The downside tone had expected since technical fundamental on weekly chart shown the evening star pattern. Today CPO expecting to continue downside biased for correction since bearish engulfing pattern formed in daily chart. CPO may bearish if open < 2685-2673 and close < 2670. But CPO may bullish tone if open > 2705-2718 and close > 2720. I'm expecting CPO may test 2660-2700 today. Take your position nicely....

Just my 2cents....

Happy Trading....

Wassalam....

Sunday, August 15, 2010

Monday Trading Tip: Bullish May Continue

Hi traders,

CPO ended higher on Friday at 2690lvl. It's try to test 2700lvl during the trading session. CPO may bullish tone if open > 2672-2697 and close > 2690. But may bearish if open < 2670-2660 and close < 2660. Meanwhile, if CPO breaks 2700lvl on Monday, it may rally for the week. However please be careful on downside correction since the weekly chart shown evening star pattern. Take your position nicely....

Just my 2cents...

Wassalam.....

Selamat Berpuasa....Ramadhan Al Mubarak

Friday, August 13, 2010

Friday Trading Tip: Inverted Hammer Sign

CPO ended lower at 2640 on Thursday. If open above 2660 tomorrow and close above 2676, the chances to bullish may rally on next week. I'm discovered inverted hammer formed in daily chart, pay attention on bullish tone tomorrow if price can breaks 2660. Take yr position nicely....

Just my 2cents....

Wassalam....

Wednesday, August 11, 2010

Thursday Trading Tip: Downside Correction

Hi traders,

CPO ended lower today at 2656lvl after super bulls tone. CPO may enter into correction phase if open < 2660-2650 and close < 2645. But it may back to bullish tone if open > 2670-2680 and close > 2700. I'm expecting CPO may further downside if open below 2660 and may test 2620-2670 again. Take your position nicely....

Just my 2cents

Happy trading

Wassalam...

Wednesday Trading Tips: I am in November Contract - Corrections in progress

Hi traders,

CPO ended lower today at 2652lvl after super bulls tone yesterday. CPO may enter into correction phase if open < 2660-2650 and close < 2650. But it may back to bullish tone if open > 2677-2698 and close > 2700. I'm expecting CPO may further downside if open below 2660 and may test 2620-2670. Take your position nicely....

Just my 2cents

Happy trading

Wassalam...

Monday, August 9, 2010

Tuesday Trading Tip: Correction after Super Bull

Hi traders,

CPO ended super higher at 2731 with higher volume......breaking a 2010 resistance level. As seen in the daily chart it seems 90 degree rocket towards 2750, but downside correction may develop. CPO will continue upside bias if open > 2720-2731 and close above > 2730. But may downside bias for correction if open < 2700-2710 and close < 2700. Major trend is still upside bias range bound towards 2750-2800. But be extra careful for downside correction. Please take your position nicely.....

Just my 2cents....

Happy Trading.....

Wassalam....

Sunday, August 8, 2010

Monday Trading Tip: Temporary downside may develop

Hi traders,

CPO ended super higher on Friday at 2661lvl with 2695 highest level of the month. CPO may continue it uptrend if open > 2645-2660 and close > 2665. Otherwise it may temporary down trend if open < 2604-2620 and close < 2605. I'm expecting CPO may make it temporary downside bias next week. However major trend is still upside biased range bound towards 2700lvl. Please take your position nicely.....

Just my 2cents....

Wassalam....

Wednesday, August 4, 2010

Thursday Trading Tip: A Doji Sign of Warning

Hi traders,

CPO ended higher today with low volume traded at 2590. The fighting between bulls and bears finally formed a Doji pattern. The sign of warning to traders either a strong downside biased may develop. If CPO open > 2592-2600 and close above 2600, the upside biased may significant. But if open < 2590-2580 and close < 2580, the downside biased may develop for correction. Maybe can go up to 2500 lvl again. However major trend is still upside biased range bound towards 2600-2700. Take your position nicely....

Just my 2cents.....

Wassalam....

Weekly Chart Trend Signal

Hi traders,

I have discovered Doji candlestick has formed in weekly chart. It seems like CPO may reverse for correction downside biased if red candlestick develops this week. So becareful.......If this scenario does not happen, CPO may rally to test 2600-2700.

Happy trading

Just my 2cents

Tuesday, August 3, 2010

Wednesday Trading Tips: Sideway upside biased

Hi traders,

CPO ended lower today at 2562 lvl with higher volume traded. Its may continue sideway downside biased if open < 2555-2538 and close < 2538. But may upside biased if open > 2565-2575 and close > 2575. I'm expecting CPO may test 2570-2600 tomorrow if overnight S.O & B.O shows positive tone. If CPO breaks 2583 lvl tomorrow, a rally may develop towards 2600. Watchout your poition......Happy Trading

Just my 2cents

Wassalam...

Sunday, August 1, 2010

Monday Trading Tip: Sideway

Hi traders,

CPO ended slightly higher on Friday at 2517, making it another sideways to range bound upside biased. CPO may strongly further upside if can break 2535 level- the further rally may develop. CPO may upside biased on Monday if open > 2530-2540 and close > 2540. But may downside biased for correction if open < 2520-2510 and close < 2505. Overall trend is still in upside biased with sideways. Take your position nicely...

Just my 2cents...

Happy Trading...

Wassalam....

Friday, July 30, 2010

Thursday, July 29, 2010

Thursday Trading Tip: Bullish Trend on-track

Hi traders,

CPO ended higher yesterday at 2495, a 2nd day of uptrend candle. It looks like bullish trend back to online if CPO open > 2485-2500 and close > 2500. But will bearish if CPO open < 2480-2470 and close < 2470. The major CPO trend still in upside biased towards 2520. I'm expecting CPO to test 2480-2510 today.

Take your position nicely...

Happy Trading...

Wassalam....

Tuesday, July 27, 2010

Wednesday Trading Tips: Correction...corrections

Assalamualaikum...

CPO ended higher today at 2485 after moving into -ve territory. Last call for CPO pushing it up again. It's looks like CPO may test 2460-2500 tomorrow if open > 2460-2485 and close > 2490. Otherwise it will downside biased for further correction if open < 2440-2420 and close < 2440. Major trend is still upside biased towards 2500. CPO started more volatile within this week as the weather pattern uncertain. Watch out your position....

Take your position nicely....

Just my 2cents.....

Wassalam....

Tuesday Trading Tip: Correction

Assalamualaikum...

CPO ended lower yesterday at 2473 lvl, a 2nd day for downside corrections. Hopefully CPO will bullish today if open > 2500-2510 and close > 2500. Otherwise CPO may bearish today if open < 2480-2475 and close < 2475. Major CPO trend is still upside biased towards 2600 lvl. I'm expecting CPO may test 2470-2500 lvl for corrections.

Take your position nicely.....

Happy trading.....

Wassalam....

Monday, July 26, 2010

Monday Trading Tip: Bullish with correction

CPO ended lower on Friday at 2498 lvl for corrections towards upside biased. CPO may bullish today if open > 2505-2520 and close > 2520. But may bearish today if open < 2497-2490 and close < 2490. However the price either bullish or bearish subject to SGS & Intertek July 1-25 export data release by today. I'm expecting CPO may test 2500-2540 today. The major trend is still in bullish tone......

Take your position nicely....

Just my 2cents...

Friday, July 23, 2010

Friday Trading Tip: A wonderful day has come

CPO ended higher yesterday with significant volume at 2519 lvl. It shown that CPO may continue it bullish tone onwards. If CPO open > 2485 - 2520 and close > 2500, the bullish tone may still exist. Otherwise it may bearish tone for correction if open > 2485. Major trend still in upside biased. I'm expecting CPO may test 2520-2560 today.

Take your position nicely....

Happy trading...

Thursday, July 22, 2010

Thursday Trading Tip: Bulls vs Bears

CPO ended higher yesterday at 2457 with high volume traded. It looks like CPO may test 2450-2480 today if open > 2454-2465 and close > 2460 and bullish tone may develop. But CPO may downside if open < 2445-2435 and close < 2435. However major trend still in upside biased. During trading hour, CPO may up & down to make it correction towards bullish tone. Please take your position nicely......

Happy Trading.....

Just my 2cents...

Thanks

Wednesday, July 21, 2010

Wednesday Trading Tips: Beware of downside correction

CPO ended lower yesterday at 2424 lvl, the lowest after 1 week trading. Expected to continue today after firm down of 1-20 export data released by SGS & Intertek. If CPO open > 2445-2455 and close > 2455 the bullish tone still exist. But if open < 2432-2420 and close < 2420 the CPO may tend to downside bias. I'm expecting the CPO to test 2420-2450 lvl. However spillover from overnight C.O & S.O may limit the downside.

Just my 2cents...

Happy trading....

Tuesday, July 20, 2010

DJ Malaysia July 1-20 Palm Oil Exports 870,604 Tons -SGS

It estimated exports at 914,649 tons for the same period in June.

Intertek Agri Services, another surveyor, estimated July 1-20 exports at 879,018 tons earlier in the day.

The following are the major items in the SGS estimate:

(All figures in tons)

Product July 1-20 June 1-20 RBD Palm Olein 384,134 448,157 RBD Palm Oil 97,371 81,824 RBD Palm Stearin 75,987 84,994 Crude Palm Oil 141,255 167,846 Total* 870,604 914,849 Major importers of Malaysian palm oil: European Union 112,311 158,620 China 121,636 310,740 U.S. 126,279 46,572 India 58,800 63,655 Pakistan 174,416 69,420 *Palm oil product volumes don't add up to total as some products aren't included. SGS Malaysia is a division of the Switzerland-based Societe Generale de Surveillance Group. -By Shie-Lynn Lim, Dow Jones Newswires; +603 2026 1233; shie-lynn.lim@dowjones.com

DJ Malaysia July 1-20 Palm Oil Exports 879,018 Tons -Intertek

The estimate is within market expectations of a 3%-4% decline in shipments

Intertek estimated exports at 906,321 tons during the June 1-20 period.

Another surveyor, SGS (Malaysia) Bhd., is expected to issue its estimate later in the day.

-By Shie-Lynn Lim, Dow Jones Newswires; +603 2026 1233;

shie-lynn.lim@dowjones.com

Monday, July 19, 2010

Tuesday Trading Tip: CPO May Tests 2440-2460

CPO ended higher today with moderate volume traded. Expected CPO may bullish tomorrow if open > 2445-2455 and close > 2460. But it may bearish if open < 2330-2440 and close < 2430. Down export data 1-20 release by SGS & Intertek tomorrow may limit the upside bias. I'm expecting CPO may test 2440-2460 lvl tomorrow, but if can break 2465 the bullish rally may exist. Overall trend still in upside bias.....

I would like to share my breakout point chart that i have took long position....Hope this is another my excellent achievement if CPO brakes 2480.....

Thanks

Happy trading.....

DJ Asian Crude Palm Oil Ends Up; Weather Threats, Supply Outlook

Growers and analysts said the rainfall may stifle palm oil output in Malaysia and Indonesia, the top two producers, crimping supply growth.

Lower yields in the states of Sabah and Sarawak have prompted trade participants and growers to cut forecasts for supply growth this month to 5% from a previous projection of 10%.

The benchmark October contract on the Bursa Malaysia Derivatives ended MYR5 higher at MYR2,454 a metric ton, after trading on both sides.

The market was in negative territory for most of the day as "the surge in prices in previous trading sessions tempted investors to lock in gains," a senior executive at global trading company said.

"Prices may trade lower this week with the imminent slowdown in exports, as the bulk of festive demand shipments has already been shipped out in early July."

Some trade participants said July 1-20 palm shipments likely declined 3%-4% on month to around 877,000 tons, which will likely prevent prices rising further.

Cargo surveyors Intertek Agri Services and SGS (Malaysia) Bhd. are due to issue their July 1-20 estimates Tuesday.

In the cash market, palm olein for October/November/December shipment was traded at $782.50/ton and $790/ton, free on board Malaysian ports, a Singapore-based trading executive said.

Cash CPO for prompt delivery was offered MYR10 higher at MYR2,520/ton.

CME Group Inc.'s dollar-based CPO futures for October delivery weren't traded during Asian hours.

Rupiah-denominated September CPO futures on the Indonesia Commodity and Derivative Exchange were trading 1.5% lower at IDR6,565 a kilogram at 0949 GMT, with 11 lots changing hands. One lot equals 10 tons.

Open interest on the BMD was 68,762 lots compared with 69,473 lots Friday. One lot is equivalent to 25 tons.

A total of 13,739 lots of CPO were traded versus 26,327 lots Friday.

Closing BMD CPO futures prices in MYR/ton at 1000 GMT: Month Close Previous Change High Low Aug'10 2,504 2,493 Up 11 2,504 2,478 Sep'10 2,474 2,470 Up 4 2,474 2,448 Oct'10 2,454 2,449 Up 5 2,455 2,429 Nov'10 2,449 2,445 Up 4 2,450 2,426 By Shie-Lynn Lim, Dow Jones Newswires; +603 2026 1233; shie-lynn.lim@dowjones.com

Monday Trading Tip: Temporary downside may develop

CPO ended higher Friday at 2449 lvl with high volume traded. Based on my experienced, CPO was in transition zone as to make new bullish trend. If it can pass the 2460 lvl and play around with this figure this week, chances to bullish is high. Today CPO may develop temporary downside for correction and will up again, but upside is limited. If CPO open > 2440-2450 and close > 2460 the bullish tone is high. But it may downside if open < 2430-2420 and close < 2420.

Just my 2cents....

Happy trading.....

Thanks & regards

Friday, July 16, 2010

Friday Trading Tip (October Contract): Bullish Sentiment May Continue

CPO ended higher yesterday. Bullish tone too strong as the demand from Pakistan surged within this week. The bullish sentiment may continue today and downside correction may develop during trading session. CPO may bullish if open > 2395-2420 and close > 2425. But it may temporary bearish if open < 2365-2380 and close < 2350. I'm expecting temporary downside correction may develop today but the major trend still in bullish tone.

Just my 2cents.....

Happy trading......

Crude Palm Oil Ends Up 2.4%; Higher Exports, Supply Worries

Palm prices powered higher towards the end of trade on the Bursa Malaysia Derivatives exchange as momentum for the rally seemed to be building tracking reports of higher demand from Pakistan in preparation for Ramadan, the Islamic month of fasting, trade participants said.

The benchmark September contract on the BMD rose as much as 2.7% to a five-week high of MYR2,445 a metric ton before ending MYR58 or 2.4% higher at MYR2,439/ton. The September contract expires today.

Pakistan, the third-largest buyer of palm oil after India and China, has bought up to 225,000 tons of palm oil in July amid rising demand.

Demand from the country may extend to August, said Rasheed Janmohammad, vice-chairman of the Pakistan Edible Oil Refiners Association.

The South Asian nation usually purchases 80,000-125,000 tons a month on average.

Cargo surveyor SGS (Malaysia) Bhd. said Pakistan imported 140,696 tons in the first 15 days of July.

“We expect August to be a heavy buying month as well, with palm oil imports likely to reach 150,000 tons,” Janmohammad told Dow Jones Newswires.

Only 20%-30% of the country’s requirements have been purchased so far for August, he added.

Earlier this month trade participants and analysts said they expected July output to rise 10% on month on a seasonal uptick in supply, but a possible supply shortfall due to lower yields in the states of Sabah and Sarawak led them to revise the growth forecast to 5%.

The Malaysian Palm Oil Board put June output at 1.42 million tons, up 2.5% on month.

Growers also said the recent heavy rainfall in several oil palm growing regions may boost future production prospects, but it has hurt palm oil extraction rates from fresh fruit bunches, slowing growth in production.

Palm prices had been under pressure in the past few months ahead of a seasonal supply increase during the July-September quarter, but rising festive demand from the Indian subcontinent and the Middle East may lead to a drawdown in palm inventories, boosting prices.

Export figures by cargo surveyors were better than market expectations of a 10%-11% rise, supporting the rally in prices.

Cargo surveyor Intertek Agri Services estimated exports in the first 15 days of July at 668,573 tons, up 11% on month, while another surveyor, SGS (Malaysia) Bhd., put the figure at 708,384 tons.

In the cash market, palm olein for October/November/December shipment was traded at $770/ton and $772.50/ton, September at $780/ton free on board Malaysian ports, a Singapore-based trading executive said.

Cash CPO for prompt delivery was offered MYR10 higher at MYR2,470/ton.

CME Group Inc.’s dollar-based CPO futures for the September contract was up $37.50 from the U.S. Monday close at $707.25, with three lots done.

The rupiah-denominated October CPO futures on the Indonesia Commodity and Derivative Exchange was trading 0.9% higher at IDR6,435 a kilogram at 0924 GMT, with 92 lots changing hands. One lot equals 10 tons.

Open interest on the BMD was 71,380 lots, versus 72,521 lots Wednesday. One lot is equivalent to 25 tons.

A total of 30,313 lots of CPO were traded versus 10,680 lots Wednesday.

Closing BMD Crude Palm Oil (CPO) futures prices in MYR/ton at 1000 GMT: Month Close Previous Change High Low Jul'10 2,465 2,460 Up 05 2,472 2,453 Aug'10 2,459 2,423 Up 36 2,473 2,428 Sep'10 2,439 2,381 Up 58 2,445 2,378 Oct'10 2,411 2,363 Up 48 2,418 2,353

-By Shie-Lynn Lim, Dow Jones Newswires; +603 2026 1233; shie-lynn.lim@dowjones.com

(END) Dow Jones Newswires

July 15, 2010 07:17 ET (11:17 GMT)

Copyright (c) 2010 Dow Jones & Company, Inc.

Thursday, July 15, 2010

Thursday Trading Tip: Bullish Trend Confirm

CPO ended higher yesterday at 2381 lvl. Strong momentum pushing up the CPO to highest lvl at 2384 due to increase export data estimates by SGS & Intertek. CPO to continue uptrend if open > 2373-2385 and close > 2390 and will downtrend if open < 2355-2365 and close < 2355. However i'm expecting CPO continue to bullish today due to bullish export data release by surveyor by today. Take your position nicely....

Just my 2cents....

Happy trading

"TRADES WITH YOUR MIND, DON'T TRADE WITH YOUR EMOTION.....OTHERWISE YOU WILL LOST"

Crude Palm Oil Ends Up 1.2%; Likely Higher July 1-15 Exports

The benchmark September contract on the Bursa Malaysia Derivatives exchange ended MYR28 higher or 1.2% higher at MYR2,381, after rising to a two-week high of MYR2,384/ton in intraday trade.

Exports for the first 15 days of July probably rose 10%-11% on month to around 668,000 tons, a Singapore-based trading executive said.

Cargo surveyor Intertek Agri Services estimated exports in the first 15 days of last month at 600,921 tons, while SGS (Malaysia) Bhd. put the figure at 608,324 tons. Both surveyors will issue July 1-15 palm oil export data on Thursday.

According to Malaysia-based growers, the recent heavy rainfall in several oil palm growing regions may boost future production prospects, but it has hurt palm oil extraction rates from fresh fruit bunches, so growth in production growth is likely to be slower.

The extraction rate of oil from palm fruit is typically in a range of 20%-25%. Growers and trade participants said that figure has declined to around 18%-18.6%.

The oil palm growing regions of Southeast Asia will likely see mostly wet weather for the rest of the week, according to Chicago-based meteorologist Mike Tannura.

Occasional rainfall and thunderstorms may bring around two inches of rain in key palm oil areas, Tannura said in a weekly report.

In the cash market, palm olein for October/November/December shipment was traded at $762.50/ton, free on board Malaysian ports, a Singapore-based trading executive said.

Cash CPO for prompt delivery was offered MYR30 higher at MYR2,460/ton.

CME Group Inc.’s dollar-based CPO futures contract wasn’t traded during Asian hours.

The rupiah-denominated October CPO futures on the Indonesia Commodity and Derivative Exchange was trading 1.7% higher at IDR6,410 a kilogram at 1045 GMT, with 183 lots changing hands. One lot equals 10 tons.

Open interest on the BMD was 72,521 lots, versus 72,201 lots Tuesday. One lot is equivalent to 25 tons.

A total of 10,680 lots of CPO were traded versus 12,376 lots Tuesday.

Closing BMD Crude Palm Oil (CPO) futures prices in MYR/ton at 1000 GMT: Month Close Previous Change High Low Jul'10 2,460 2,449 Up 11 2,460 2,451 Aug'10 2,423 2,395 Up 28 2,428 2,400 Sep'10 2,381 2,353 Up 28 2,384 2,357 Oct'10 2,363 2,335 Up 28 2,366 2,340

-By Shie-Lynn Lim, Dow Jones Newswires; +603 2026 1233; shie-lynn.lim@dowjones.com

(END) Dow Jones Newswires

July 14, 2010 06:59 ET (10:59 GMT)

Copyright (c) 2010 Dow Jones & Company, Inc.

Wednesday, July 14, 2010

Wednesday Trading Tips: Bullish Sign TRENDING

CPO ended higher yesterday at 2353 lvl. Positive sentiment expected to continue today as the overnight C.O & S.O in bullish tone. CPO may test 2340-2365 level if open > 2340-2355 and close > 2357. But may go down if open < 2325-2335 and close < 2320. I'm expecting CPO to open high today.......

Just my 2cents....

Happy trading...

Thanks & regards

Tuesday, July 13, 2010

DJ Asian Crude Palm Oil Ends Up 0.6% On Short Covering, Crude

The benchmark September contract on the Bursa Malaysia Derivatives exchange ended MYR13 or 0.6% higher at MYR2,353 a metric ton after moving in a MYR2,325-MYR2,354 range.

Export shipments are gaining momentum and this may support the market, said a Kuala Lumpur-based executive at an international trading company.

Cargo surveyor Intertek Agri Services estimated Malaysia's palm oil exports during the July 1-10 period rose 9% to 474,928 tons, while another surveyor put exports in the same period at 460,343 tons.

Many among trade participants said selling pressure over the past few weeks and lower palm inventory levels have reduced the downside potential for prices for now, with strong support for prices around MYR2,280-MYR2,300/ton.

But if soyoil futures continue to decline later on the CBOT, it will have a spillover impact on palm oil, said a Kuala Lumpur-based analyst.

December soyoil was trading 12 points lower at 38.24 cents a pound by the end of trade on the BMD.

Short-term forecasts by analysts point to lower palm oil prices over the next few months despite a bullish crop report by the Malaysian Palm Oil Board as production is expected to recover and may rise to a peak in the

September-November period.

"We believe the shortfall in palm production could be a reflection of the general shortage of foreign workers in Malaysia, which resulted in lower-than-expected yields. Output should recover seasonally in the next few

months," Tan Ting Min, an analyst at Credit Suisse Malaysia, said.

Despite the weak growth in June production, a double-digit rise in output this month would probably mean inventory levels may reach higher levels at end-July, analysts and plantation company executives said.

In the cash market, palm olein for September shipment was traded at $765/ton, and for October/November/December at $757.50/ton, free on board Malaysian ports, said a Singapore-based trading executive.

Cash CPO for prompt delivery was offered MYR10 lower at MYR2,430/ton.

CME Group Inc.'s dollar-based CPO futures contract and the rupiah-denominated September CPO futures on the Indonesia Commodity and Derivative Exchange weren't traded during Asian hours.

Open interest on the BMD was 72,201 lots, versus 73,512 lots Monday. One lot is equivalent to 25 tons.

A total of 12,376 lots of CPO were traded versus 15,227 lots Monday.

Closing BMD CPO futures prices in MYR/ton at 1000 GMT: Month Close Previous Change High Low Jul'10 2,450 2,440 Up 10 2,450 2,438 Aug'10 2,395 2,384 Up 11 2,398 2,375 Sep'10 2,353 2,340 Up 13 2,353 2,325 Oct'10 2,335 2,321 Up 14 2,335 2,310 -By Shie-Lynn Lim, Dow Jones Newswires; +603 2026 1233; shie-lynn.lim@dowjones.com

Tuesday Trading Tip: +ve Direction of CPO

CPO ended high yesterday at 2338 lvl due to positive export data and lack of CPO inventories data reported by MPOB. The bullish sentiment too strong pushing the price highest up to 2341 lvl. The bullish trend will continue today if open > 2325-2340 and close >2345. But the CPO will downtrend if CPO open < 2300-2315 and close < 2300. I'm expecting CPO will temporary downtrend today, then climbing back immediately to test 2340-2350 lvl.

Take your position nicely.....

Just my 2cents....

Thanks

Crude Palm Oil Ends Up 1.7%; Inventories Down, Output Slower

The benchmark September contract on the Bursa Malaysia Derivatives ended MYR38 or 1.7% higher at MYR2,338 a metric ton. The contract never fell below the previous close during the session. Traders put immediate resistance for the benchmark at MYR2,350/ton.

The Malaysian Palm Oil Board surprised investors with their issuance Monday of data on exports, production and end-month inventories in June.

"Investors weren't expecting stocks to fall. This (MPOB data) lifted sentiment and induced buying interest during the afternoon session," a Kuala Lumpur-based trading executive said.

MPOB estimated palm oil inventories at 1.45 million tons, down 7.1% from end-May, compared with market expectations of an increase to around 1.59 million tons.

Palm oil output rose only 2.5% in June to 1.42 million tons, below market expectations of a 5%-10% rise.

Cargo surveyor Intertek Agri Services Saturday estimated Malaysia's palm oil exports during the July 1-10 period up 9% at 474,928 tons.

Another surveyor, SGS (Malaysia) Bhd., estimated the exports in the same period at 460,343 tons. Palm shipments to Pakistan, a major edible oils consumer, reached 93,750 tons, up more than five-fold from the same period in May, data from SGS showed.

Intertek data showed a two-fold increase in shipments to the Middle East at 38,490 tons for the July 1-10 period, from 18,800 tons in June.

Investors were also tracking the progress of monsoon rains in India, as any prolonged delay could hurt crop production and push up vegetable oil prices.

In the cash market, palm olein for August shipment was offered $10 higher at $795/ton.

Cash CPO for prompt delivery was offered MYR10 higher at MYR2,440/ton.

CME Group Inc.'s dollar-based September CPO futures contract for September was up $8.00 from its U.S. close at $724/ton.

Rupiah-denominated September CPO futures on the Indonesia Commodity and Derivative Exchange were 2.9% higher at IDR6,300 a kilogram at 0925 GMT, with four lots done.

The October contract was trading 0.4% higher at IDR6,295/kg with 80 lots changing hands. One lot is equivalent to 10 tons.

Open interest on the BMD was 73,512 lots, versus 72,569 lots Friday. One lot is equivalent to 25 tons.

A total of 15,227 lots of CPO were traded versus 16,138 lots Friday.

Closing BMD Crude Palm Oil (CPO) futures prices in MYR/ton at 1000 GMT: Month Close Previous Change High Low Jul'10 2,440 2,430 Up 10 2,449 2,435 Aug'10 2,384 2,344 Up 40 2,385 2,356 Sep'10 2,338 2,300 Up 38 2,341 2,310 Oct'10 2,321 2,287 Up 34 2,322 2,295By Shie-Lynn Lim, Dow Jones Newswires; +603 2026 1233; shie-lynn.lim@dowjones.com

(END) Dow Jones Newswires

July 12, 2010 06:37 ET (10:37 GMT)

Copyright (c) 2010 Dow Jones & Company, Inc

Monday, July 12, 2010

DJ Malaysia July 1-10 Palm Oil Exports 460,343 Tons -SGS

The estimate is better than market expectations of a 6.8% rise in shipments.

SGS estimated exports at 423,199 tons for the same period in June.

Another surveyor, Intertek Agri Services, put July 1-10 palm oil exports at 474,928 tons Saturday.

The following are the major items in the SGS estimate:

(All figures in metric tons)

July 1-10 June 1-10

RBD Palm Olein 203,351 179,084

RBD Palm Oil 50,753 51,649

RBD Palm Stearin 46,563 29,898

Crude Palm Oil 77,750 96,953

Total* 460,343 423,199

Major importers of Malaysian palm oil:

European Union 70,781 98,117

China 74,136 116,125

U.S. 69,674 40,172

India 7,800 27,602

Pakistan 93,750 18,000

*Palm oil product volumes don't add up to total as some products aren't

included.

SGS Malaysia is a division of the Switzerland-based Societe Generale de

Surveillance Group.

DJ * Malaysia June CPO Output 1.42 Mln Tons; Up 2.5% On Month -MPOB

CPO output totaled 1.39 million tons in May.

MPOB said in its monthly report that CPO exports rose 5.5% to 1.44 million tons in June. The country exported 1.36 million tons in May.

Palm oil inventories totaled 1.45 million tons at the end of June, down 7% from 1.56 million tons in May.

The following are details of the June crop data and revised numbers for May, issued by MPOB:

June May Change

On Month

Crude Palm Oil Output 1,420,062 1,385,424 Up 2.5%

Palm Oil Exports 1,440,884 1,365,637 Up 5.5%

Palm Kernel Oil Exports 60,227 112,480 Down 46%

Palm Oil Imports 61,028 114,397 Down 47%

Closing Stocks 1,451,434 1,562,323 Down 7.1%

Crude Palm Oil 715,821 813,986 Down 12.1%

Processed Palm Oil 735,613 748,337 Down 1.7%

(All figures are in tons)

-By Shie-Lynn Lim, Dow Jones Newswires; +603 2026 1233;

shie-lynn.lim@dowjones.com

DJ MARKET TALK: BMD CPO Futures May Open MYR5-MYR15 Higher

9% on month. Kuala Lumpur-based analyst tips MYR2,305-MYR2,325/ton. Benchmark September contract finished MYR11 higher at MYR2,300/ton Friday. Nymex August crude trading 1 cent higher at $76.10/bbl on Globex. (shie-lynn.lim@dowjones.com)

Call us in Kuala Lumpur: +(603) 2026 1233

Sunday, July 11, 2010

Monday Trading Tip: Bull vs Bear

CPO ended high last Friday at 2300 lvl. CPO export data from both ITS and SGS above expectations and C.O & B.O traded higher during Asian trading hour. Soybean stock ended low reported by USDA and might give +ve direction to CPO. I'm expecting CPO may bullish Monday if open > 2300-2310 and close >2320. If CPO breaks 2323-2325 tomorrow, it may rally uptrend for the whole day. But it may downside if open <2293-2297 and close < 2290.

Take your position nicely......

Just my 2cents.....

Thanks

Friday, July 9, 2010

DJ Asian Crude Palm Oil Ends Up; July 1-10 Exports Likely Higher

The benchmark September contract on the Bursa Malaysia Derivatives ended MYR11 higher at MYR2,300 a metric ton, after moving in a MYR2,293/ton-MYR2,320/ton range.

Trade participants anticipate palm oil export data by cargo surveyor Intertek Agri Services due Saturday will point to rising demand as a major Islamic festive season looms.

A shipping executive in Penang said Malaysia's palm oil shipments in the first 10 days of July likely rose 6.8% from the same period a month earlier, to around 465,000 tons. Another surveyor, SGS (Malaysia) Bhd., is due to release its export estimate Monday.

Intertek and SGS pegged June 1-10 palm oil shipments at 435,148 tons and 423,199 tons, respectively.

Strong demand in the physical market lent support to the rise in futures prices, cash-market brokers said.

"Buyers have made brisk purchases to cover their requirements when prices fell to their lowest level on Wednesday," a senior trading executive at a Kuala Lumpur-based brokerage said.

A strong vessel lineup at Malaysian ports indicates exports will likely be higher for the first half of this month, he said.

"Major palm oil buyers such as India and Pakistan are back in the market," an executive at a global trading company said.

Some among trade participants liquidated positions ahead of a supply and demand crop report by the U.S. Department of Agriculture due later Friday that will confirm tight U.S. soybean crop and another, from the government-linked Malaysian Palm Oil Board due Monday.

In the cash market, trade was active with palm olein for August changing hands at $772.50/ton, free-on-board Malaysian ports, September at $757.50/ton and $760/ton and October/November/December at $747.50/ton.

Cash CPO for prompt delivery was offered MRY20 higher at MYR2,430/ton.

CME Group Inc.'s dollar-based September CPO futures contract for September was up $3.50 from its U.S. close at $721.25/ton, with one 25-ton lot traded.

Rupiah-denominated September CPO futures on the Indonesia Commodity and Derivative Exchange were 1% higher at IDR6,300 a kilogram at 1023 GMT, with 141 lots done.

The October contract was trading 1% higher at IDR62,600/kg with 217 lots changing hands. One lot is equivalent to 10 tons.

Open interest on the BMD was 72,569 lots, versus 74,093 lots Thursday. One lot is equivalent to 25 tons.

A total of 16,138 lots of CPO were traded versus 14,674 lots Thursday.

Closing BMD CPO futures prices in MYR/ton at 1000 GMT: Month Close Previous Change High Low Jul'10 2,429 2,420 Up 09 2,440 2,425 Aug'10 2,344 2,330 Up 14 2,366 2,338 Sep'10 2,300 2,289 Up 11 2,320 2,293 Oct'10 2,287 2,275 Up 12 2,302 2,279 -By Shie-Lynn Lim, Dow Jones Newswires; +603 2026 1233; shie-lynn.lim@dowjones.com

DJ MARKET TALK: BMD CPO Futures May Open MYR5-MYR10 Higher

fell vs ringgit to MRY3.1900 vs MYR3.1925 yesterday. Benchmark September contract ended MYR20 higher at MYR2,290/ton. August crude oil trading 30 cents up at $75.74/bbl on Globex.

(shie-lynn.lim@dowjones.com)

Call us in Kuala Lumpur: +(603) 2026 1233

Friday Trading Tip: CPO May test 2300 due to bullish overnight SO & CO

CPO closed at 2289 lvl Thursday. Its strongly pushed by S.O & C.O during Asian trading hours. CPO tested again 2300 and surge to highest lvl at 2310. It may uptrend today if CPO open >2296-2300 and close > 2305. But it may downtrend if open < 2285-2290 and close < 2285.

CPO likely to test back 2300 lvl due to bullish overnight S.O & C.O, but upside may limited. Overall trend is downside bias towards 2250.

NYMEX C.O@ 7.00am = 75.76 (+0.32) E-CBOT@7.00am = 36.67 (-0.14)

Just my 2cents....

Happy trading....

Thursday, July 8, 2010

DJ Asian Crude Palm Oil Ends Up 0.9% On Crude, U.S. Soybean Crop Fears

The benchmark September contract on the Bursa Malaysia Derivatives exchange ended MYR20 or 0.9% higher at MYR2,290 a metric ton after moving in a MYR2,286-MYR2,310 range.

The market got a boost from rally in external markets including crude oil, and a drop in soybean crop ratings, giving spillover buying interest in palm oil market.

August crude oil on the New York Mercantile Exchange rose as much as 1.4% to $75.10 a barrel in Asia. At 1011 GMT, August contract was trading 78 cents higher at $74.85/bbl.

"Any further weather issues (in U.S.) may lift (palm) prices higher. And those on short positions will be treading cautiously," said a Kuala Lumpur-based trading executive.

Soyoil futures rose to a one-week high Wednesday on the Chicago Board of Trade on support from lower soybean crop outlook. December soyoil ended 100 points higher at 37.69 cents a pound.

Nevertheless, concerns about rising output and end-month inventory levels will cap the rise in palm prices.

"Prices need to end above MYR2,330-MYR2,340/ton levels in the next trading session to sustain gains," said a Kuala Lumpur-based analyst.

June output probably rose 5%-10% on month and the supply may rise further in July as the palm oil sector in Malaysia moves into the high output cycle period, trade participants and analysts said.

The Malaysian Palm Oil Board is expected to issue Malaysia palm oil production, stock and export data for June on Monday.

In the cash market, palm olein for September was traded at $755/ton and both October/November/December and January/February/March shipments traded at $747.50/ton, said a Singapore-based trading executive.

Cash CPO for prompt shipment was offered MYR20 higher at MYR2,410/ton.

CME Group Inc.'s dollar-based CPO futures contract for September wasn't traded in Asia.

Rupiah-denominated September CPO futures on the Indonesia Commodity and Derivative Exchange were trading 1.1% higher at IDR6,270 a kilogram at 0924 GMT, with 123 lots done.

The October contract was trading 0.9% higher at IDR6,200/kg with 208 lots changing hands. One lot is equivalent to 10 tons.

Open interest on the BMD was 74,093 lots, versus 74,304 lots Wednesday. One lot is equivalent to 25 tons.

A total of 14,674 lots of CPO were traded versus 14,018 lots Wednesday.

Closing BMD CPO futures prices in MYR/ton at 1000 GMT: Month Close Previous Change High Low Jul'10 2,420 2,398 Up 22 2,423 2,410 Aug'10 2,330 2,305 Up 25 2,349 2,325 Sep'10 2,290 2,270 Up 20 2,310 2,286 Oct'10 2,275 2,250 Up 25 2,294 2,270 By Shie-Lynn Lim, Dow Jones Newswires; +603 2026 1233; shie-lynn.lim@dowjones.com

Wednesday, July 7, 2010

I did it again : 1000 Pt within 5 days

Just want to share my 3rd excellent achievements within this year doing CPO trading. I hope all of you also gains the same profit. This results using my SNIPER TRADING technique which was i developed myself through experience & research.

Thanks

Thursday Trading Tip: I did It again 1000 pt in 5 days

CPO closed at 2370, the lowest level this year. Bearish sentiment still strong to weigh CPO towards 2200 if supply fundamental, SO & CL no +ve news to push the price up. CPO expecting to pullback correction tomorrow if open > 2290-2295 and close > 2290. But it may downside if open < 2275-2280 and close < 2270. Today sellers were dominating the war. For tomorrow i'm expecting CPO may go to 2250 level if overnight CO & SO in bearish mood. For long term trend CPO still in downside bias towards 2250 and 2200 level.

Just my 2cents...

Happy trading

DJ Asian Crude Palm Oil Ends Down 1.3% On Rising Supply Fears

Concerns about the global economic recovery also weighed on prices, trade participants said.

The benchmark September contract on the Bursa Malaysia Derivatives exchange ended MYR31 or 1.3% lower at MYR2,270 a metric ton after moving in a MYR2,270-MYR2,303/ton range.

The market was initially buoyed by strength in crude oil prices. But without strong buying support, and with supplies rising in Indonesia and Malaysia--both major global palm oil producers--palm prices quickly gave up gains and slipped into negative territory.

Some trade participants expect prices to come off their lows in the next trading session as "the slew of bearish news and expectations for June output to be higher on month were already factored into today's slide," said a senior trading executive at a Kuala Lumpur-based brokerage.

Prices have been battered the past few weeks, declining 7.3% since June 1 due to worries about the strength of the global economic recovery and bearish supply outlooks.

"Though prices may come off their lows, any upside will be limited on fears that palm olein will trade at a higher premium over rival soyoil," said a Malaysia-based exporter.

Trade participants said Malaysia's palm oil output in June probably rose around 5%-10% on month with end-June palm oil inventory levels around 1.70 million tons.

The Malaysian Palm Oil Board is expected to issue June palm oil production, stock and export data Monday.

In the cash market, palm olein for July was offered $5 lower at $775/ton, while cash CPO for prompt shipment was offered MYR10 lower at MYR2,390/ton.

CME Group Inc.'s dollar-based CPO futures contract for September wasn't traded in Asia.

Rupiah-denominated September CPO futures on the Indonesia Commodity and Derivative Exchange were trading 0.9% lower at IDR6,205 a kilogram at 1015 GMT, with 177 lots done.